How to Borrow Money from Cash App: Quick & Easy Guide

To borrow money from Cash App, you can follow these steps: 1. Open the Cash App on your mobile device.

2. Tap on the “Cash” tab at the bottom of the screen. 3. Enter the amount you want to borrow. 4. Tap on the “Borrow” option. 5. Review the terms and conditions, and tap “Agree. ” 6. Provide any additional information requested.

7. Tap “Confirm” to complete the borrowing process. Cash App is a popular mobile payment service that allows users to send and receive money conveniently. While it primarily functions as a peer-to-peer payment app, Cash App also offers the option to borrow money. Whether you need extra funds for an emergency or a planned expense, borrowing money from Cash App can provide a quick and hassle-free solution. We will explore the steps to borrow money from Cash App and guide you through the process. By following these steps, you can easily access the funds you need without the complexities associated with traditional loan applications. So, let’s dive in and learn how to borrow money from Cash App efficiently.

Credit: www.wikihow.com

Introduction To Cash App Borrow Feature

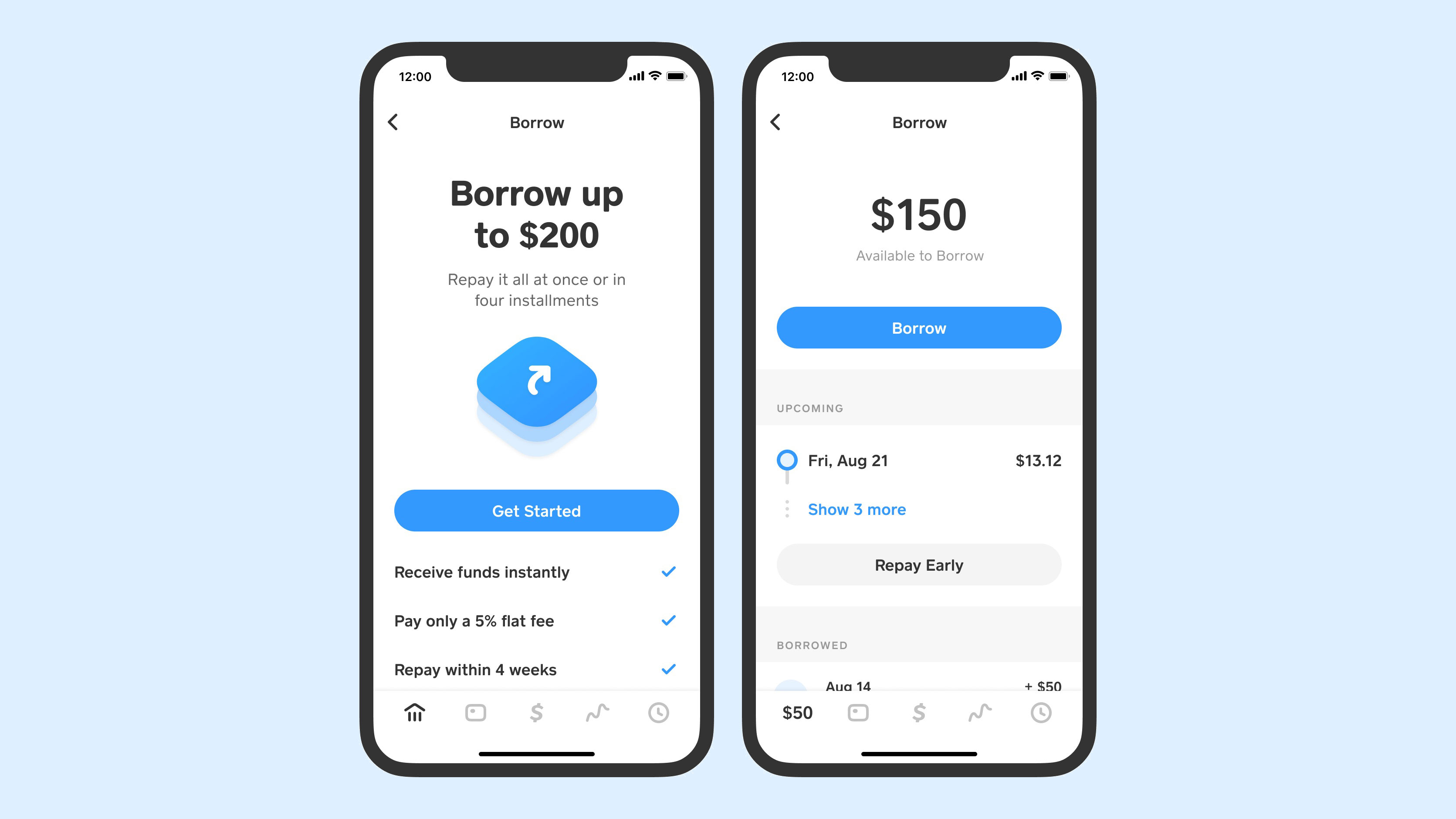

Cash App’s Borrow feature allows users to easily access money when needed. With a simple process, users can borrow money from Cash App without any hassle or complicated procedures. It’s a convenient solution for those looking for quick financial assistance.

What Is Cash App?

Cash App is a mobile payment platform that allows users to send and receive money from friends and family. It is a free-to-use platform that has gained popularity due to its user-friendly interface and convenience. Cash App also offers other features such as investing in stocks, Bitcoin, and now, borrowing money.

The Borrow Feature

The new Cash App borrowing feature allows users to borrow money from the app. This feature is available to users who meet specific requirements, such as having an active Cash App account and a good credit score. The borrowing feature is easy to use and provides users with a quick and efficient way of obtaining funds.

Cash App’s borrowing feature is a new addition to the platform, and it is gaining popularity due to its convenience. With this feature, users can borrow money quickly and easily without having to go through a traditional bank or lending institution. In this blog post, we will guide you through the process of borrowing money from Cash App, including the requirements, how to access the feature, and how to pay back the borrowed amount. Keep reading to find out more!

Credit: m.youtube.com

Eligibility Criteria For Borrowing

Before borrowing money from Cash App, it’s essential to understand the eligibility criteria to ensure a smooth process.

Account Requirements

- Create a Cash App account

- Link a valid bank account

- Ensure your account is in good standing

Creditworthiness Assessment

- Cash App evaluates your credit history

- Assesses your repayment capability

- Considers your income sources

Step-by-step Guide To Borrow Money

Looking to borrow money from Cash App? Follow this step-by-step guide to make the process smooth and hassle-free. First, ensure your Cash App account is verified and in good standing. Then, navigate to the “Cash” tab, enter the amount you wish to borrow, and follow the prompts to complete the transaction.

Borrowing money can be a convenient solution when you are in need of funds. Cash App offers a simple and straightforward process to help you borrow money quickly and hassle-free. In this step-by-step guide, we will walk you through the process of accessing the borrow option and completing the loan application.

Accessing The Borrow Option

Before you can apply for a loan on Cash App, you need to have the borrow option enabled on your account. Follow these steps to access the borrow option:

- Open the Cash App on your mobile device.

- Sign in to your account using your login credentials.

- Once you are logged in, navigate to the home screen of the app.

- Locate and tap on the “Borrow” tab. This will take you to the borrowing section of the app.

- If you don’t see the “Borrow” tab, it means the feature is not available for your account. In this case, you may need to meet certain eligibility criteria or wait for the feature to be rolled out to your region.

Loan Application Process

After accessing the borrow option, you can proceed with the loan application process. Here’s how:

- On the borrowing section of the app, you will find information about the loan terms, interest rates, and repayment options. Take some time to review this information before proceeding.

- Once you are ready to apply for a loan, click on the “Apply Now” button.

- You will be prompted to enter the loan amount you wish to borrow. Make sure to enter an amount within the allowed limits.

- Next, review the loan terms and conditions and click on the “Accept” button if you agree to them.

- Provide any additional information or documentation required for the loan application. This may include verifying your identity, income, and employment details.

- After submitting the required information, your loan application will be reviewed. The approval process may take some time, so be patient.

- If your loan application is approved, the funds will be deposited directly into your Cash App account.

- Make sure to carefully review the repayment terms and schedule to ensure timely repayment of the loan.

That’s it! By following these step-by-step instructions, you can easily borrow money from Cash App and meet your financial needs. Remember to borrow responsibly and only take out a loan if you are confident in your ability to repay it.

Understanding Loan Terms

To borrow money from Cash App, it’s important to understand the loan terms. Make sure to read and comprehend the interest rates, repayment period, and any associated fees before accepting the loan. This will help you avoid any unexpected costs and ensure timely repayment.

Before borrowing money from Cash App, it is important to understand the loan terms. This will ensure that you are aware of the interest rates, repayment period, and loan limits.

Interest Rates

The interest rate is the cost of borrowing money. Cash App charges a fixed interest rate of 5% on the amount borrowed. This means that if you borrow $100, you will have to pay back $105.

Repayment Period

The repayment period is the time frame in which you have to pay back the loan. Cash App offers a repayment period of four weeks. This means that you have to pay back the loan within four weeks of borrowing the money.

Loan Limits

Cash App offers loans ranging from $20 to $200. The loan amount that you are eligible for depends on several factors, such as your credit score, income, and spending patterns. Cash App uses an algorithm to determine the loan amount that you are eligible for. To summarize, before borrowing money from Cash App, it is important to understand the loan terms, including the interest rates, repayment period, and loan limits. Make sure that you can afford to repay the loan within the given time frame and that you do not borrow more than you need.

Managing Repayments

Managing repayments when borrowing money from Cash App is crucial to maintaining a positive financial standing. Whether you opt for autopay or manual repayment options, staying on top of your payments is essential. Let’s explore the two primary methods for managing your loan repayments.

Setting Up Autopay

Autopay simplifies the repayment process by automatically deducting the due amount from your linked account on the scheduled date. To set up autopay:

- Open the Cash App and navigate to the loan section.

- Select the “Autopay” option.

- Enter your preferred payment method and authorize the recurring deductions.

- Review and confirm the autopay setup to ensure seamless repayments.

Manual Repayment Options

If you prefer to have more control over your repayments, Cash App also offers manual options:

- Access the loan section within the Cash App.

- Choose the “Manual Repayment” option.

- Select the amount you wish to repay and the payment method.

- Follow the prompts to complete the manual repayment process.

Credit: techcrunch.com

Troubleshooting Common Issues

Having trouble borrowing money from Cash App? Don’t worry, we’ve got you covered! Our troubleshooting guide provides step-by-step solutions to common issues, helping you navigate through the process smoothly and efficiently. Say goodbye to borrowing woes and hello to hassle-free transactions with Cash App.

Borrow Option Not Available

If you’re having trouble finding the “Borrow” option on Cash App, don’t worry, there are a few possible reasons for this. Firstly, make sure that you have the latest version of the app installed on your device. Sometimes, the option may not be available if you are using an outdated version. If you have the latest version and still can’t find the “Borrow” option, it’s possible that it is not yet available in your country or region. Cash App’s features may vary depending on your location, so it’s worth checking if borrowing money is supported in your area.

Another reason why the “Borrow” option may not be available is if your Cash App account does not meet the eligibility criteria. Cash App determines eligibility based on various factors such as your account history, transaction patterns, and creditworthiness. If your account does not meet the requirements, you may not see the “Borrow” option. If you believe that you meet all the necessary criteria and still cannot access the “Borrow” option, it’s best to reach out to Cash App support for further assistance. They will be able to provide you with specific information and help troubleshoot the issue.

Declined Loan Applications

If your loan application on Cash App has been declined, there are a few potential reasons for this. Firstly, ensure that you have entered all the required information correctly. Any discrepancies or inaccuracies in your application could result in a declined loan. Take a moment to double-check all the details before submitting your application.

Another reason for a declined loan application could be your credit history. Cash App considers your creditworthiness when reviewing loan applications. If you have a poor credit score or a history of missed payments, it could affect your chances of approval. Improving your credit score and maintaining a good payment history can increase your chances of successfully borrowing money through Cash App.

Additionally, if your loan application exceeds the borrowing limit set by Cash App, it will likely be declined. Cash App sets borrowing limits based on various factors, including your account history and transaction patterns. If you have reached your borrowing limit, consider paying off existing loans or reducing your outstanding balance before applying for a new loan. Remember, a declined loan application does not mean that you won’t be able to borrow money in the future. Take the time to address any issues that may have resulted in the decline, and work on improving your eligibility for future loan applications.

In conclusion, troubleshooting common issues when borrowing money from Cash App involves understanding why the “Borrow” option may not be available and addressing potential reasons for declined loan applications. By ensuring you have the latest app version, meeting eligibility criteria, entering accurate information, maintaining a good credit history, and staying within borrowing limits, you can increase your chances of successfully borrowing money through Cash App.

Pros And Cons Of Borrowing From Cash App

Borrowing money from Cash App can be convenient in times of need. However, like any financial decision, it comes with its own set of advantages and drawbacks.

Advantages

- Quick and easy application process.

- Instant access to funds in your Cash App account.

- No credit check required for borrowing.

- Flexible repayment options available.

Potential Drawbacks

- High fees and interest rates compared to traditional loans.

- Risk of impacting your credit score if not repaid on time.

- Limited borrowing amounts based on your Cash App account history.

- Potential for overspending and accumulating debt.

Alternatives To Cash App Borrowing

Exploring Alternatives to Cash App Borrowing can provide additional options for obtaining funds. Consider these alternatives:

Other Micro-loan Services

Other platforms offer similar micro-loan services like Cash App, such as:

- PayPal Credit

- Chime Credit Builder

- Branch

Traditional Loan Sources

Consider these traditional sources for borrowing money:

- Banks and Credit Unions

- Peer-to-Peer Lending

- Credit Cards

Safety And Security Measures

When borrowing money from Cash App, it is crucial to prioritize safety and security measures to protect your financial information.

Cash App’s Security Protocols

Cash App implements robust security protocols to safeguard user data.

- End-to-end encryption protects all transactions and personal information.

- Biometric authentication ensures only authorized users can access accounts.

- Real-time fraud monitoring detects and prevents suspicious activities.

Best Practices For Users

Users can enhance their security by following these best practices:

- Enable two-factor authentication for an added layer of security.

- Regularly review account activity to spot any unauthorized transactions.

- Keep the app updated to benefit from the latest security patches.

Conclusion And Final Thoughts

After successfully navigating the process, borrowers can easily access funds through Cash App. Final thoughts highlight the convenience and efficiency of borrowing money through this user-friendly platform. With minimal hassle and quick transactions, Cash App provides a seamless borrowing experience.

Summary Of Key Points

When considering borrowing money from Cash App, understanding the process is essential.

Transparency and clarity are crucial for making informed financial decisions.

Making An Informed Decision

Ensure you have a clear repayment plan before borrowing via Cash App.

Consider all fees and interest rates to avoid unexpected financial burdens.

Frequently Asked Questions

How Can I Borrow Money From Cash App?

To borrow money from Cash App, you can apply for a Cash App loan through the app if you are eligible. The loan amount will be deducted from your Cash App balance, and you will need to repay it with a small interest fee.

What Are The Eligibility Criteria For Cash App Loans?

To be eligible for a Cash App loan, you need to have a good transaction history on Cash App, link a bank account, and have a steady income. Cash App will assess your transaction history and account activity to determine your eligibility.

What Is The Process For Applying For A Cash App Loan?

To apply for a Cash App loan, open the Cash App, navigate to the “Banking” tab, and select “Cash App Loans. ” Follow the prompts to check your eligibility and apply for a loan. If approved, the loan amount will be deposited into your Cash App balance.

Conclusion

Borrowing money from Cash App is a convenient option for users in need of quick funds. By following the simple steps outlined in this guide, you can access the app’s features and secure a loan hassle-free. With its user-friendly interface and seamless process, Cash App provides a reliable solution for financial emergencies.